Ohio Suta Wage Base 2025. Ohio unemployment tax rates will increase for experienced employers in 2025, according to an update on the department of job and family services website. 14 update on the state job and family services website.

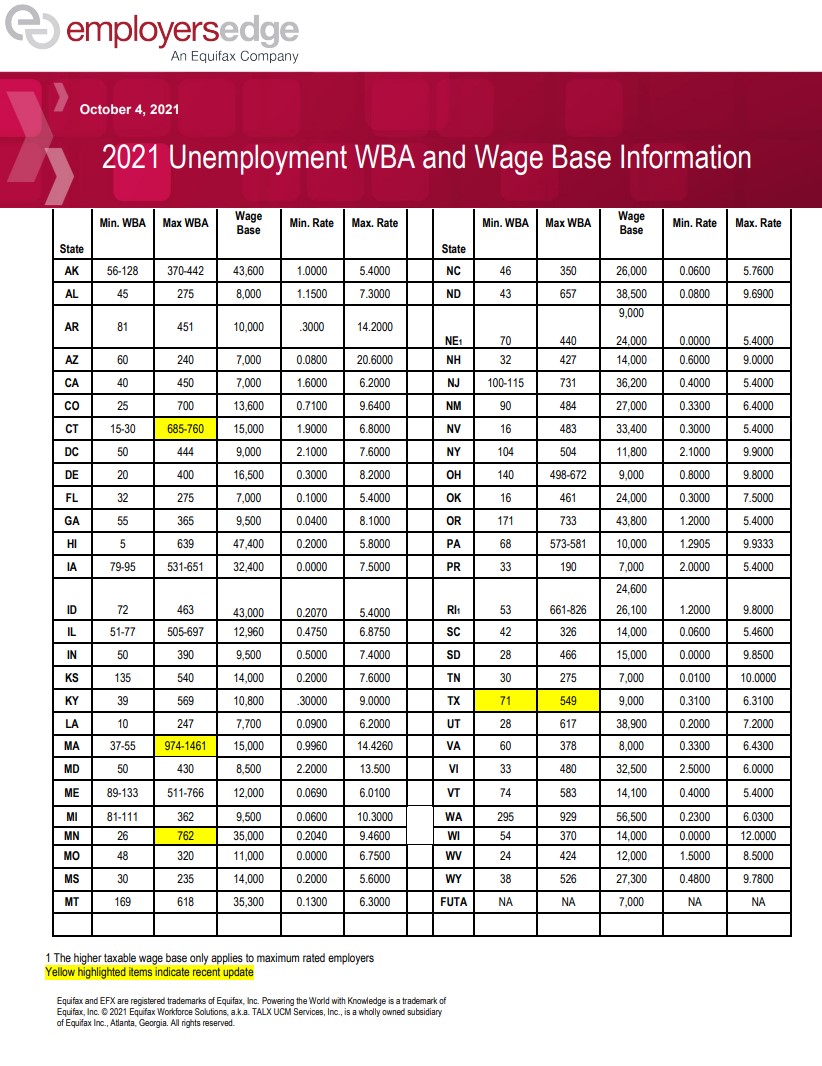

An updated chart of state taxable wage bases for 2025 to 2025 (as of february 7, 2025) may be downloaded from the payroll.org 2025 tax calculator for ohio.

An updated chart of state taxable wage bases for 2025 to 2025 (as of february 7, 2025) may be downloaded from the payroll.org

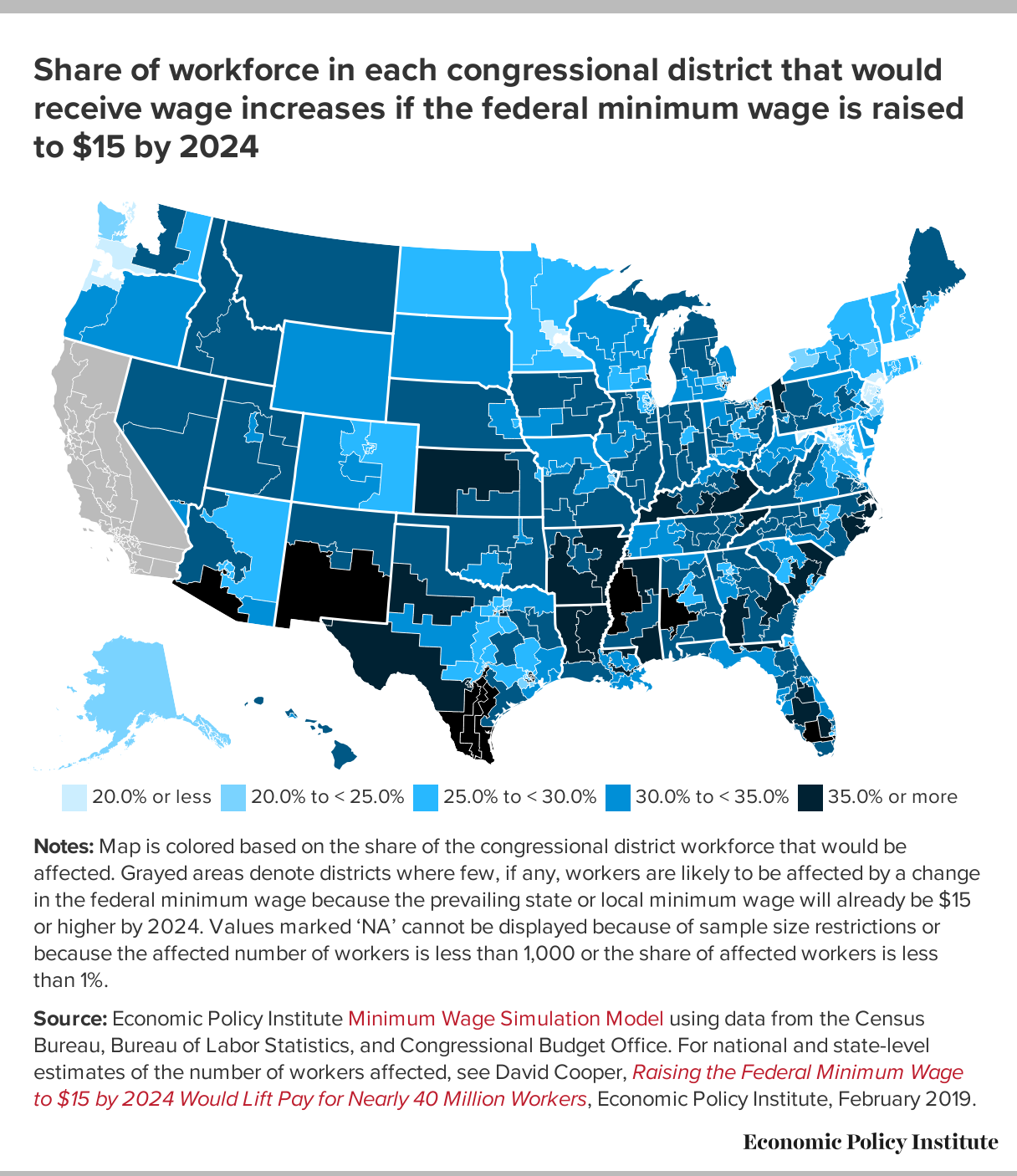

Minimum Wage 2025 By State Map Penni Blakeley, An updated chart of state taxable wage bases for 2025 to 2025 (as of february 7, 2025) may be downloaded from the payroll.org The 2025 tax rates and thresholds for both the ohio state tax tables and federal tax tables are comprehensively integrated into the ohio tax.

Ohio State Unemployment Wage Base YUNEMPLO, For each year thereafter, computed as 16% of the state's. Several states have released their state unemployment insurance taxable wage bases for 2025 in a chart provided and updated by payo.

2025 SUTA Wage Base Rundown by State Nextep, That amount, known as the taxable wage base, has been. For example, north carolina’s 2025 suta.

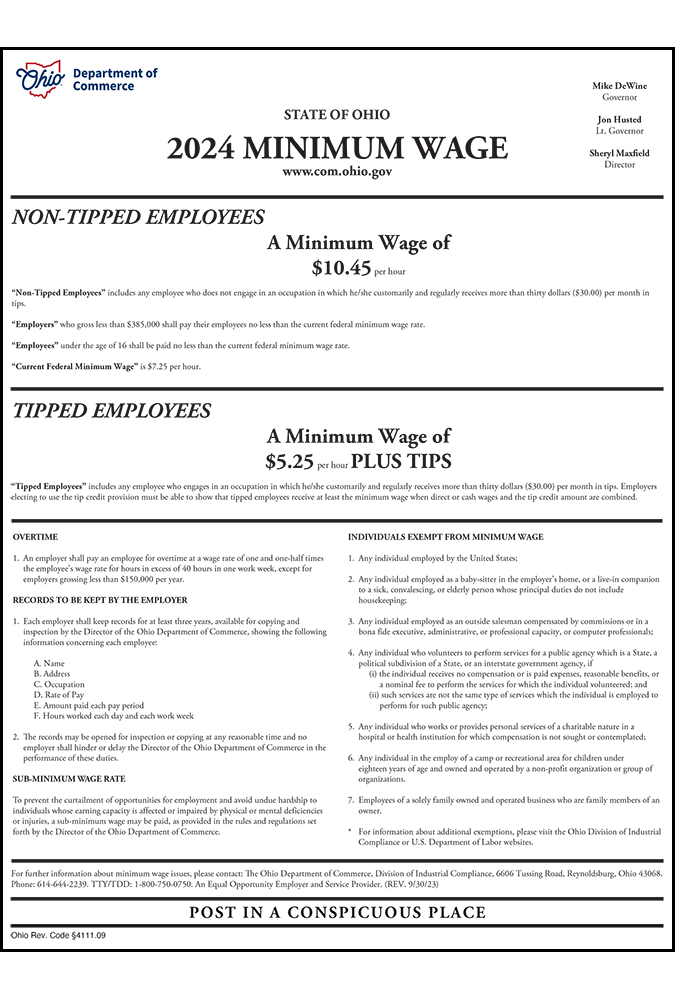

Minimum Wage In Ohio 2025 Per Hour Gwyn Portia, The taxable wage base remains $9,000. For example, north carolina’s 2025 suta.

State Wage Base Chart Employer's Edge, Employers should be aware that due to. For each year thereafter, computed as 16% of the state's.

What You Need to Know About Taxable Wages 3 Things, Employers should be aware that due to. The taxable wage base remains $9,000.

SUTA Wage List General instructions, Several states have released their state unemployment insurance taxable wage bases for 2025 in a chart provided and updated by payo. Employers should be aware that due to.

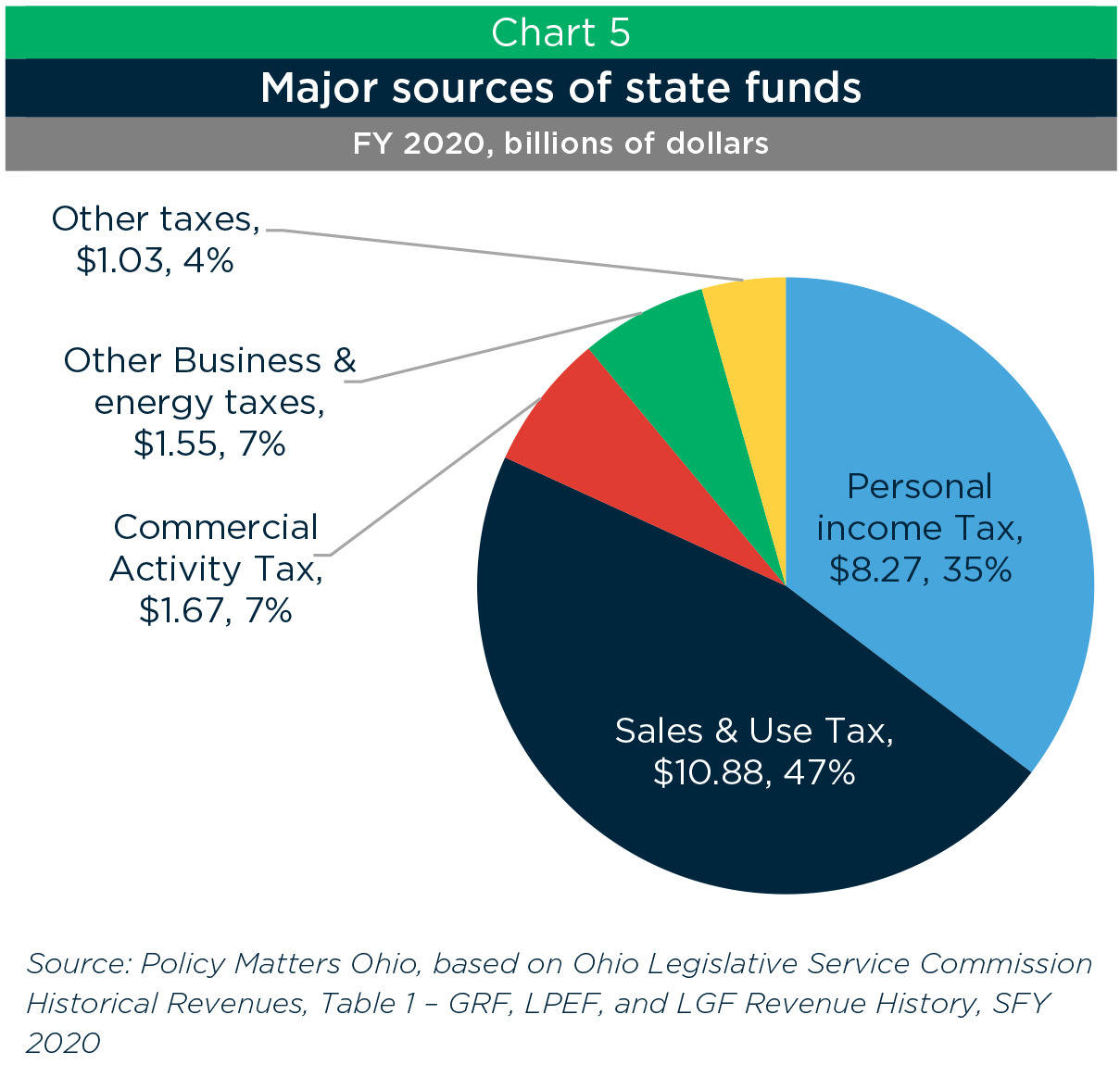

Unemployment Benefits Chart, Calculate each employee’s net pay, cut those checks (or transfer those direct. Unemployment insurance tax rates in ohio will range from 0.3% to 9.8% in 2025, according to a nov.

What Is SUTA Tax? Definition, Rates, Example, & More, Calculate each employee’s net pay, cut those checks (or transfer those direct. Several states have released their state unemployment insurance taxable wage bases for 2025 in a chart provided and updated by payo.

Ohio posts backtoback months of unemployment rates at 4 or below for, Employers only pay suta tax for income up to and including their state’s wage base. For each year thereafter, computed as 16% of the state's.

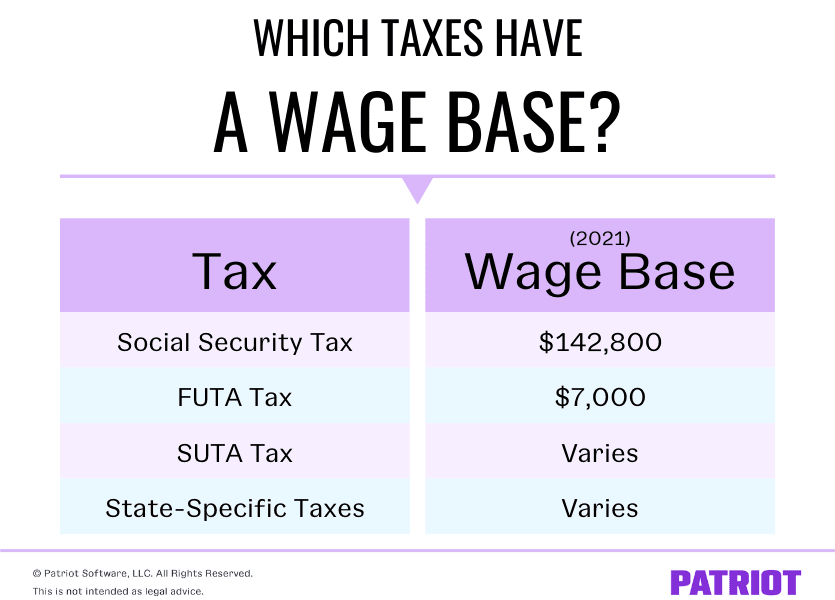

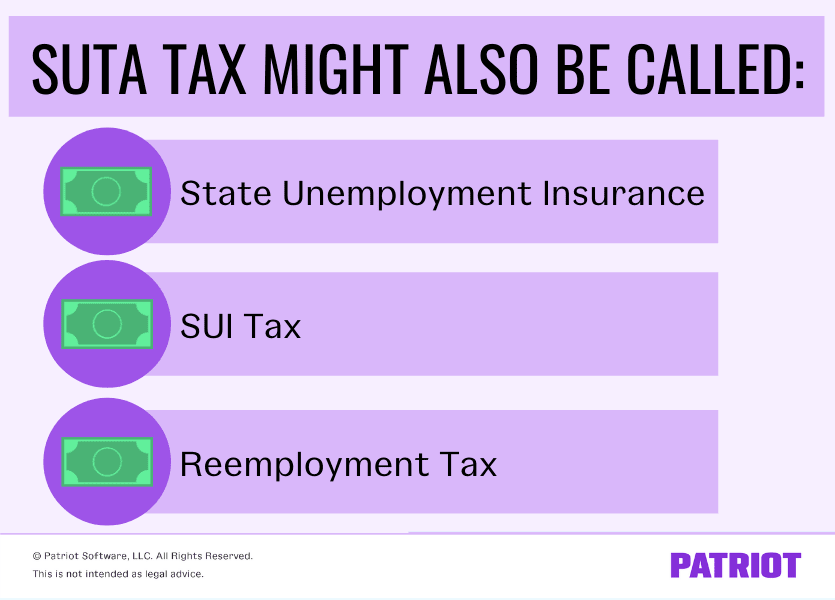

State unemployment tax assessment (suta) is based on a percentage of the taxable wages an employer pays.

If you file your application during 2025, you must have an average weekly wage of at least $328 before taxes or other deductions.