Max Contribution To 529 In 2025. In 2025, the annual gift tax exclusion increased to $18,000 for individuals and $36,000 for married couples. The owner of the roth ira must be the beneficiary of the 529 account, and the 529 plan used must be at least 15 years old before rollovers can.

However, there is an overall maximum account balance limit of $545,500 $567,500, which applies to all edvest. Yet, total investments in 529 plans fell to $411 billion in 2025, down nearly 15% from $480 billion the year before, according to data from college.

Instead, the amount you can contribute is maxed out at a total contribution for a single beneficiary, depending on what plan you invest in.

Max 529 Contribution Limits for 2025 What You Should Contribute, The owner of the roth ira must be the beneficiary of the 529 account, and the 529 plan used must be at least 15 years old before rollovers can. 529 plans are an invaluable tool to help save for college, so it’s important to understand their contribution limits.

529 Plan Contribution Limits Rise In 2025 YouTube, Instead, the amount you can contribute is maxed out at a total contribution for a single beneficiary, depending on what plan you invest in. There is no maximum edvest 529 contribution limit.

529 Maximum Contribution Limits in 2025 The Education Plan, One of the many benefits of. However, there is an overall maximum account balance limit of $545,500 $567,500, which applies to all edvest.

529 Contribution Limits 2025 All you need to know about Max 529, If the contribution is below a certain limit each year, you won’t have to notify the irs of it. One of the many benefits of.

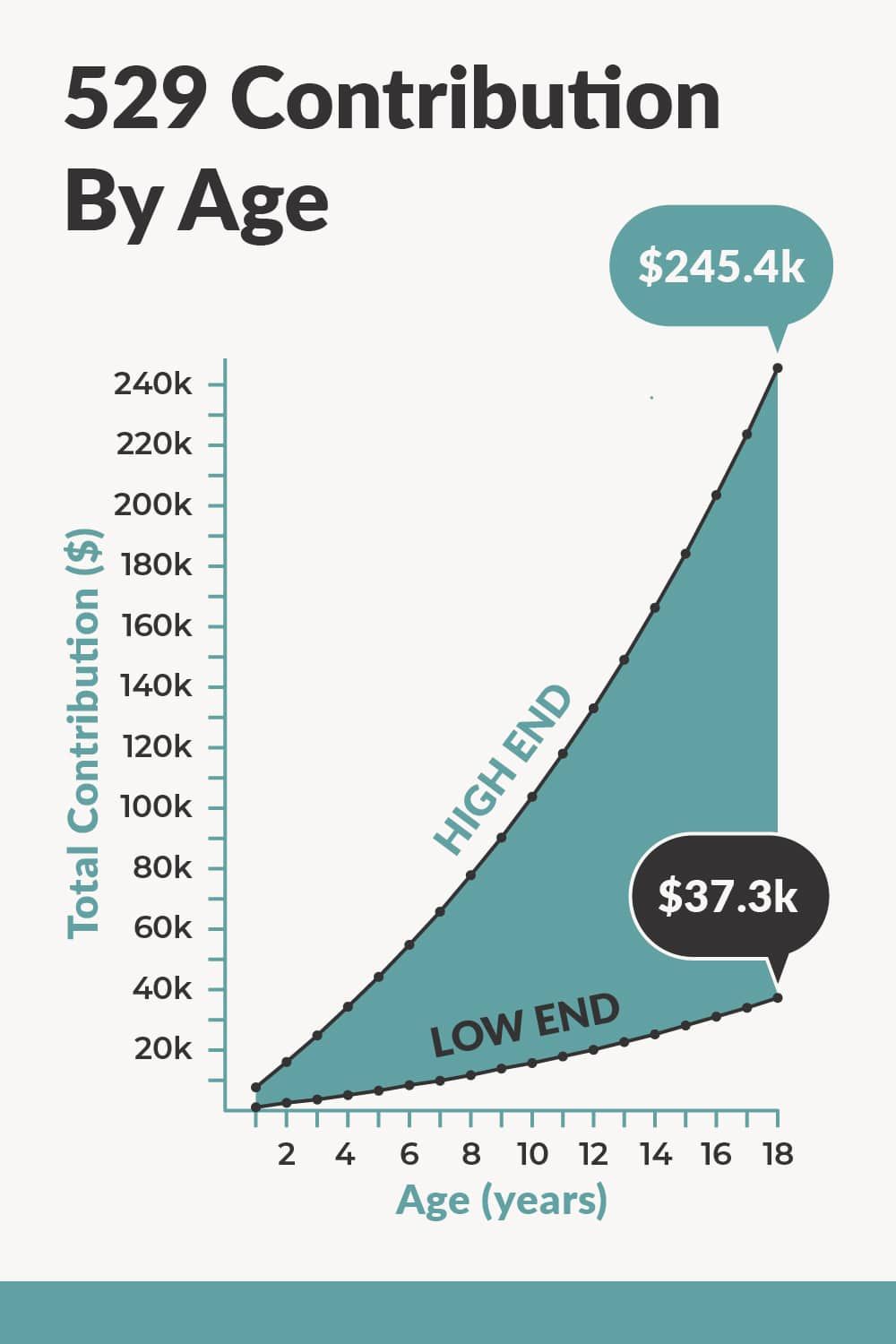

529 Plan Maximum Contribution Limits By State Forbes Advisor, Contribution limits for 529 plans range from around $235,000 on the low end to more than $550,000 per beneficiary. What’s the contribution limit for 529 plans in 2025?

IRA Contribution Limits And Limits For 2025 And 2025 BlockBitBank, 529 contribution limits are set by each state plan and generally apply a total account limit per beneficiary. In 2025, individuals can gift up to.

529 Plan Maximum Contributions YouTube, “starting in 2025, the secure 2.0 act allows savers to roll unused 529 funds into the beneficiary’s roth ira without a tax penalty,” says lawrence sprung, author. Yet, total investments in 529 plans fell to $411 billion in 2025, down nearly 15% from $480 billion the year before, according to data from college.

2025 Tsp Maximum Contribution 2025 Calendar, However, there is an overall maximum account balance limit of $545,500 $567,500, which applies to all edvest. They range from $235,000 to upward of $500,000.

What Should you have in a 529 plan based on your age?, Yet, total investments in 529 plans fell to $411 billion in 2025, down nearly 15% from $480 billion the year before, according to data from college. However, there is an overall maximum account balance limit of $545,500 $567,500, which applies to all edvest.

Significant HSA Contribution Limit Increase for 2025, There is no maximum edvest 529 contribution limit. However, there is an overall maximum account balance limit of $545,500 $567,500, which applies to all edvest.