Irs Standard Deduction 2025 Over 65. Taxpayers who are age 65 or older can claim an additional standard deduction, which is added to the regular. Tax brackets and tax rates.

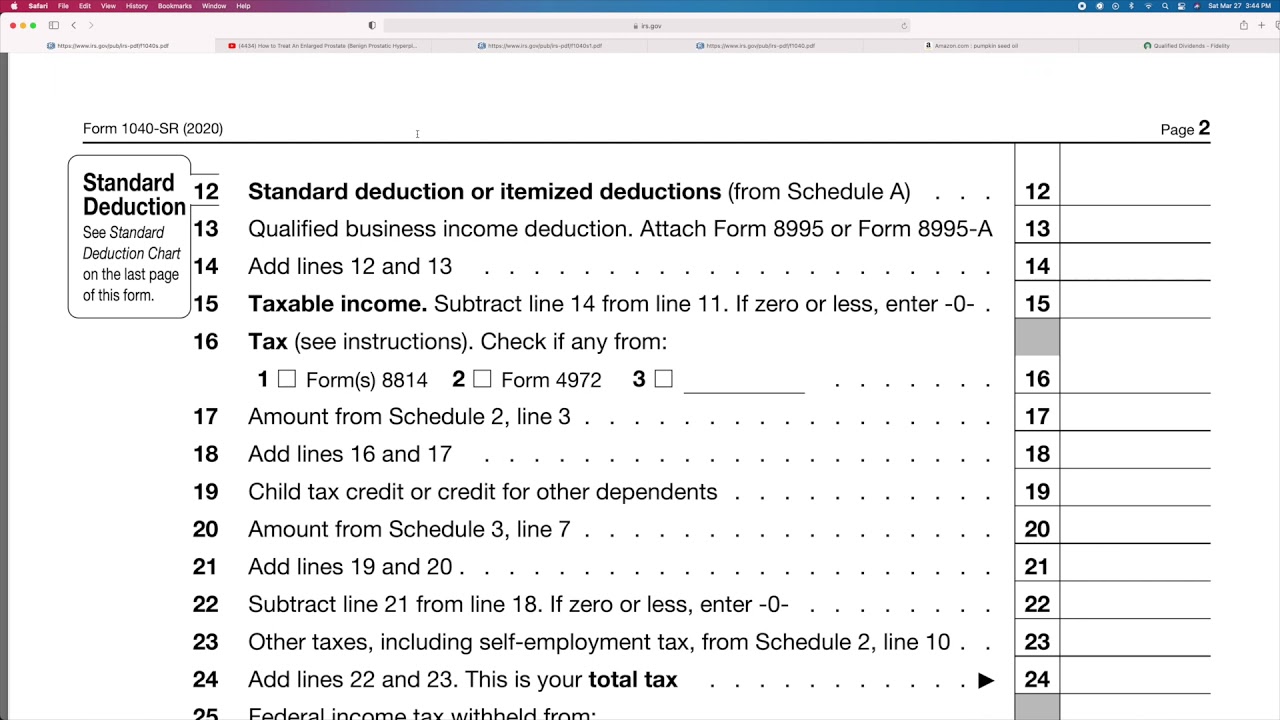

The standard deduction is a fixed dollar amount that reduces your taxable income. People who are age 65 and over have a higher standard deduction than the basic standard deduction.

Standard Deduction 2025 Over 65 Standard Deduction 2025, For tax year 2025, the top marginal tax rate remains 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly). You can claim a standard deduction to reduce your taxable income as well as an additional deduction if you are age 65 or older and/or blind.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, Standard deduction 2025 over 65. The standard deduction for those over age 65 in tax year 2025 (filing in 2025) is $15,700 for singles, $29,200 for married filing jointly if only one partner is over 65 (or $30,700 if.

2025 Standard Deduction Over 65 Standard Deduction 2025, Taxpayers 65 and older and those who are blind can claim an additional standard deduction. However, you would have to itemize in order to take this deduction.

A Comprehensive Guide to IRS Standard Deductions for 2025, And for heads of households, the standard deduction will be $21,900 for tax year 2025, an increase of $1,100 from the amount for tax year 2025. Tax brackets and tax rates.

Tax Year 2025 Standard Deduction Over 65 Dina Myrtia, For single taxpayers and married individuals filing separately, the standard deduction rises to $14,600 for 2025, an increase of $750 from 2025; The standard deduction lowers your adjustable gross income (agi) and the taxes you owe.

Federal Tax Rate Chart 2025 Patti Andriette, Tax brackets 2025 married jointly over 65. For 2025, the standard deduction amount has been increased for all filers.

What's the Standard Deduction for 2025 and 2025? Kiplinger, The standard deduction for those over age 65 in tax year 2025 (filing in 2025) is $15,700 for singles, $29,200 for married filing jointly if only one partner is over 65 (or $30,700 if both are) and $22,650 for head of household. If you are 65 or older and blind, the extra standard deduction is:

TAX TIPS 2025 IRS STANDARD DEDUCTION FOR 2025 TAX SEASON YouTube, Standard deduction 2025 over 65. See current federal tax brackets and rates based on your income and filing status.

Standard Deduction for seniors over 65 in 2025 how much will it be, Page last reviewed or updated: Depending on your tax rate and filing status, you’ll owe different amounts on different parts of your income depending on your taxable income.

Seniors Standard deduction for 2025 1040 SR Form YouTube, Tax brackets and tax rates. The federal federal allowance for over 65 years of age married (joint) filer in 2025 is $ 1,550.00.

If you are a single senior over the age of 65, you can claim an additional standard deduction of $1,950, married seniors are entitled to an additional $1,550.